John Arnold is widely regarded as the greatest natural gas trader of all time, but in his late 30’s he walked away from it all and turned full-time philanthropist. He and his wife have committed to strategically give away most of their vast fortune in their lifetime and are already doing so at a staggering pace of nearly a half billion dollars a year. In this episode, John explains his quest to address the most challenging social programs plaguing the country, including criminal justice, health care policy, and K-12 education. John also shares self-identified attributes that contributed to his success in natural gas trading and how those same traits have translated to his philanthropic aspirations.

Subscribe on: APPLE PODCASTS | RSS | GOOGLE | OVERCAST | STITCHER

We discuss:

- John’s background, upbringing, and early entrepreneurial tendencies [3:50];

- John’s time and rise at Enron [16:45];

- Characteristics that made John an exceptional natural gas trader and how they translate to his philanthropic work [27:30];

- The collapse of Enron [35:00];

- The success of John’s hedge fund, and his early interest in philanthropy [40:30];

- The infamous 2006 trade that brought down Amaranth Advisors [55:45];

- John’s analytical prowess and emphasis on fundamentals [1:02:15];

- The decision to become a full-time philanthropist and the founding of Arnold Ventures [1:09:00];

- Education—John’s quest to fundamentally change K-12 education [1:18:45];

- Strategic philanthropy—preventing problems by attacking root causes and creating structural change [1:24:30];

- The criminal justice system—structural changes needed to address mass incarceration, policing practices, and recidivism [1:31:45];

- Re-imagining prisons to reduce recidivism [1:49:00];

- US health care policy—John’s focus on drug prices, and the severe consequences of not making system changes [1:56:15];

- Climate change—the bipartisan role of John’s foundation [2:13:45];

- Advice for young adults interested in philanthropy [2:17:45]; and

- More

Get Peter’s expertise in your inbox 100% free.

Sign up to receive An Introductory Guide to Longevity by Peter Attia, weekly longevity-focused articles, and new podcast announcements.

John’s background, upbringing, and early entrepreneurial tendencies [3:50]

Who is John?

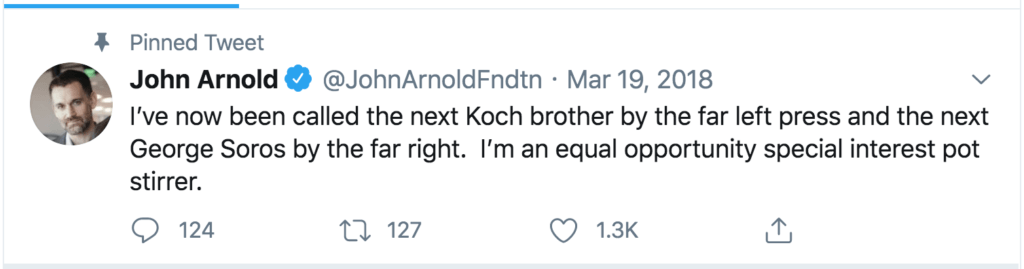

- He’s an “equal opportunity special interest pot stirrer”

Figure 1. An equal opportunity special interest pot stirrer. Image credit: Twitter – @JohnArnoldFndtn

- John and his foundation get major flack from both the left and the right politically (Therefore, the issues he attempts to zoom in to are ones where the left and the right are starting to come together)

- Prior to the foundation, John made his fortune as a natural gas trader

Arnold Ventures

- Arnold Ventures, the foundation founded by John and his wife Laura, is currently focusing mostly on health policy, public finance platforms, and criminal justice

- Foundation gives about 400 million away each year

“Our philanthropic intent is to give away the vast majority of our money during our lifetime.”

An entrepreneur from a young age

- John was an entrepreneur and an aspiring businessman starting as a young kid

- At 12 he mowed lawns but realized not much money and too much competition

- Started selling sports cards at age 14

- With the trading card work, he basically figured out geographical areas of arbitrage within the trading card industry and created a business out of it

“I ended up spending a couple summers just full time on this baseball card, really geographic arbitrage and information arbitrage, that I would have a sense of who the best buyer was for every product.”

Defining arbitrage—

- “I would describe arbitrage as taking advantage of price differences with little to no risk.”

- Today with the internet, a lot of that arbitrage and pricing inefficiencies have gone away or have been, what’s called in the trade, “Arbed out”

What he wanted to do after college

“I was the guy that was trying to get out of there and into the game as quickly as possible. Every day I was at college, it was one less day that I had to be in the game.”

- From a young age, John knew he wanted to be in Wall Street

- He didn’t know much about it, but he felt like it was the “biggest game around”

- The books Liar’s Poker as well as Barbarians at the Gate intensified his interest

- During college, he was focused on getting out of there and into the game as quickly as possible

- Despite not being recruited heavily, he talked his way into an interview at Enron and was offered an analyst position

John’s time and rise at Enron [16:45]

- John arrived at Enron in 1995, before it was all that well-known

- Historically, Enron was a pipeline company

- The natural gas industry was regulated heavily until 1992 when it became deregulated

{end of show notes preview}

Would you like access to extensive show notes and references for this podcast (and more)?

Check out this post to see an example of what the substantial show notes look like. Become a member today to get access.

John Arnold

John Arnold is an American billionaire, former hedge fund manager, and is widely regarded as the most successful natural gas trader of all time. Since retiring from energy trading in 2012, John now focuses on his political activism through Arnold Ventures LLC.